Tag Archives: Medicare

Whether you are only 65 years old or having a Medicare Plan, then it is the right time to opt for your best Medicare supplement plans 2021 as well as also for lots of great reasons. Together with the greatest supplemental options once can save dollars and get the best coverage which aren’t offered with their own original Medicare approach.

Over 10 million individuals of Medicare Program have been covered by the Supplement Program. These sorts of ideas may also be called Medigap program also additionally helps since the expensive share of expenditures which aren’t correlated with your original Medicare strategy, like coinsurance, deductibles and co payments. Together with Medicare strategies one could simply acquire 80% coverage of their entire bills and the remaining 20 percent has to be paid back by the contributor out of their pocket. So, to pay those 20% added expenses that the Medicare Supplement Plans 2021 are introduced. It covers the added expenses and prevents you to spend your pocket expenditure on health bills.

Which exactly are Medicare Supplement Plans 2021?

Medicare Supplement Plans 2021 May Be the supplemental plan that covers most the Out-of-pocket expenses and charges which aren’t insured by your present Medicare approach. This consists of the co payments, coinsurance along with the statute of Section One and Part B. The reason it is popular now amongst the Medicare program readers is that it shields the policyholder out of all the out of pocket expenditures.

This supplemental strategy offers reassurance when seeing medical Facility for therapy having less money . It’s the finest supplemental plan which allows one to visit health care without even worrying about the added bills. Besides, additionally, it insures the foreign emergency travel to get medical care outside the world. That you really do not have to be concerned regarding the healthcare therapy cost away from the nation since it’s insured with the supplementary plan.

The risk of diseases increases in the older Accendo Medicare Supplement plans age; therefore, People look for Accendo Medicare Supplement programs to pay their own medical requirements. We are going to go over these wellness plans within this post.

Shields people in older era

These Wellness programs Will Safeguard You from deadly Diseases from the older era. If you are concerned about the amount of money for financing your own treatments, in case you subscribe to your trusted health plan, you’ll receive your medicines on time. On occasion the strain brought on by health problems leads to acute problems; however, whenever you’ve subscribed to all these wellness programs, then that you don’t have some stress in your life.

It insures your requirements

These health plans cover the all-important needs of this Patients. Make sure that you are scrutinizing your wellbeing plan, everybody else has their own health requirements, and also the overall plans supplied by your health plans may not cover your requirements. These wellness plans are crucial especially for the people facing critical wants, plus they should stop by a medical facility daily and then, they need to register to those wellness plans to make certain that their health bills have been paid punctually.

These programs are cheap

The Superior Thing Regarding These Wellness programs will be that they are Cheap for elderly people. The visits to the hospital grow in the older period, the adults should perhaps not register to these wellness plans, even should they do, they should undergo coverage for the specific wellness condition which they are confronting. Total coverage will price them lots of money.

It Is Likewise recommended to seek Aid from your Health Care Provider Before signing up for all these health plans, your family doctor is aware of the health conditions faced by you and your family and could allow you to locate the best health strategy on the industry. You should look for the ideal treatment method, even supposing it’s high priced.

Some People are overly Medicare advantage plans for 2021 associated with other elements of daily life that they forget forget about a few monetary decisions which are absolutely must to take. We end up so busy in our lives that we scarcely ever consider certain facets which may greatly reduced our burden. One particular such element is that a human medicare benefit approach 2021. Even when you are financially feeble or driving, you may get this insurance plan effortlessly, as it is by far the most economical plan ever.

Exactly how can this Insurance Policy Program, helpful For all you ?

To get All the elderly citizens out there, that live from the retirement they obtain, you must be facing a lot of difficulty needing to cover off enormous medical expenses and drugs. It will get overwhelming sometimes. Thus, certainly one of these wise decisions is always to get the insurance policy coverage that only covers a tiny part of your monthly cash flow, however, helps you in various manners. It has inpatient and out patient care, ambulance solutions, ER visits prescription drugs, surgeries, medical evaluations, and a great deal more. You receive a number of benefits out of it.

If Your current strategy is expiring, and this could be the best option which you may get. Along with the root medi cal aid, you obtain lots of amounts of health policy that may cost you a fortune in case you do not get exactly the coverage.

Thus, Try out the human medicare advantage prepare 2021 now!

Medicare supplement plan G could be the healthinsurance plan the pay the full price tag of outside of pocket Medicare expenses, including coinsurance, co-payments and additional fees. This insurance coverage provides discretionary health coverage that may be inserted to the original Medicare plan coverage plan. Generally, the insurance policy plan G packs more of the expenses than additional supplement plan type s. For this reason, it has got the higher top which you have to cover to avail the extra coverage.

Private insurance companies Providing Approach G Medicare could set their own premiums, but also the plan will continue being standard offering the very same policy for example others. Some of the companies also offer you extra benefits for Medicare Part G programs.

What will be the

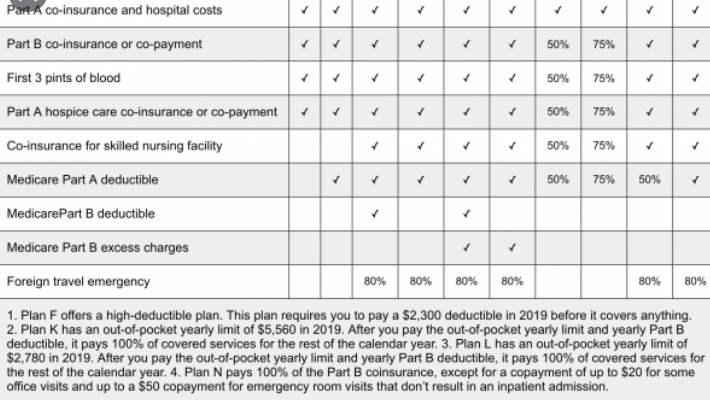

Together with Medicare Supplement Plan G insurance an individual can enjoy the subsequent policy.

• A Healthcare Facility Co Insurance and costs Upto one year following the Initial Medicare drained

• Hospice maintenance co-insurance and also other Copayments

• Part A Deductibles

• Preventive care Co Insurance policy

• Part B Co Insurance and also copayment coverage

• Excessive charges of Section B

• Expense of three pints of blood for drug therapy

• Skilled Nursing Facility care co-insurance coverage

• Australian travel emergency policy up to the limit of this program

The Program G Medicare Insurance Plan would be the sole Product on the market that covers 100 percent of Part B excess fees. Extortionate expenses are paid out once doctors and providers don’t accept that the Medicare assignment. In such case, a doctor charges the patients more than accredited level in Medicare. Without the Strategy G Medicare insurance, the patients have been accountable for paying the extra expenses out in their account. However, Medicare Supplement Plan G pays off these expenses for you. In any case, personal is also qualified for foreign travel emergency policy under the master plan that covers emergency wellness costs outside their home state.

It Is quite a standard issue nearly every where that elderly people are somewhat more inclined to get conned than many the others. The abundant types are not always targeted victims. Nowadays fewer income awards have the chance of getting scammed fiscally.

Even the More sad part is the fact that the majority of that time period it turns out that the natives are concealing in your household. It can be anyone, for example like – kids, a comparative, grandchildren, etc..

In This specific post, we’ll know about the prospective dangers an older faces, just in the event there is financial misuse.

Health-insurance fraud

In The US, every older over 65 have the ability to have Medicare benefits. It is understood to everyone. The scams may happen in various methods.

A Person can pretend for always a Medicare wellness company and ask for the private details. He or she can even provide you with an imitation service and charge you to it.

On Steer clear of these, you’ll be able to look at taking the’ Medicare supplement plans 2021. Through exhaustive exploration, it is rather simple to know any trustworthy Medicare providers providers.

Drug Ripoffs

This One is very common in this scamming business. Most seniors browse the web when they must modify their medicines and they then fall in the snare of a medication scammer. They will take the income and can provide nothing or a bogus medication.

Antiaging Services and Products

Many Elderly opt to choose services or drugs to look youthful. The scammers have this chance to offer a number of counterfeit or harmful antiaging services and products into the seniors.

Mobile phone Cons

Scammers Do imitation telemarketing calls for innocent elderly people and prey . They persuade them to buy many things which they don’t really need and probably won’t even get.

Fake lottery Ripoffs

This Way individuals indicate their purpose and then persuade them that they have won a lottery. To get the amount of money the target is requested to pay for some type of charge by check or something similar to this. The prize funds gets taken by the victim’s account afterwards.

Additional Cons

Some Other very common scams include house loan cons, investment scams, internet scams, etc..

No, there isn’t anything fresh from the plans of Accendo Medicare Supplement plans 2021, the strategies also have remained as they were. Afterward , the question arises that if there is not anything fresh afterward are we discussing this? We’re discussing this to create people alert to their losses and whether or not they are investing in an erroneous strategy, which may change the investment decision of cash to depreciation of their hard-earned money.

The plans from Medicare are offered by Distinct companies or firms, and also the purchase price can be also put by them, although the agencies and the facilities continue being steady anywhere. So, it absolutely up to the client’s pick from do they would like to purchase the program. Someone should always go throughout the requirements and about all the plans just before purchasing any, simply to be conscious of which could possibly be absolutely the absolute most proper plan for them, and then buy it.

Plans available are as follows-

• Approach A

• Plan-B

• Plan F

• Prepare G

• Plan M

• Strategy N, etc..

Some items concerning the strategies

• A Person Could enrol in Plan F, only should they have registered themselves in Plan A and B previously.

• Prepare G is approximately Very similar to program F, there is just a single gap that in Plan G, the customer must cover Strategy B but in prepare F the cost of Strategy B has been deducted from the own charge.

• Plan N will endure Whilst the Most famous program with optimum coverage and affordable price tag.

Yet another program is inserted beneath the Medicare higher level complement approach, which is portion D. component D has an additional facility to the fee of these prescribed drugs.

Registration

The enrollment process starts from October 15 and finishes from December 7. People registered during this age can start their aims from January 1, 2021. Moreover, in case somebody has switched sixty five and it has missed the registration dates then they are able to enroll themselves involving January 1, 2021, to March 3 1, 2021.

So, end up registered in the Accendo Medicare Supplement plans and keep your valuable life and money, and enhance your wellness and purchase the plan according to the current requirement of one’s wellness.

Humana Medicare Advantage plans 2021 are a hot and a well-known source of procuring the long run using no emotional problems to be manufactured on healthcare expenditures. Time and again people have lobbied for its expanding significance and credibility which includes helped millions in demand. It consists of a number of useful plans that may help cover a lot of locations about the health care field and it has costs. It has been exceptionally satisfactory and effective for individuals lying at the close of this spectrum, so that is the older citizens and have helped them to deal with a number of difficulties efficiently and effortlessly.

Why Don’t We research the nice attributes of Humana Medicare Advantage Plans 2021 with certain particulars:

Humana Medicare Advantage plans 2021 has been quite a blessing for those seeking its help and support since it’s helped them save money and stay it to get other necessary usage. Such health plans are a prerequisite nowadays given that health can be a vitally important and essential portion of our own lives and needs to be awarded the essential interest and care. Thus, certain varieties of medical insurance coverage are definitely favorable and favorable in the long term.

Humana Medicare Advantage plans 2021 is certainly worth it

Humana Medicare Advantage plans 2021 as stated above, is just one of the wise choices to earn life as it delivers a range of features which just gets smarter and better. Hence, such an investment and also a choice altogether is unquestionably worth all the moment, money and efforts.

Medicare Part F

When senior citizens are on the look for powerful Coverage about their health care costs, they generally prefer deciding on Medicare prepare F. MedicarePartF.org. Is the website in which seniors can get probably the most useful of this Medicare Supplement Plans comprehensive policy. The site acknowledges it doesn’t offer the plan, but it also offers seniors quotations from different companies concerning the program. It is possible to effortlessly assess those quotes to discover the top deal linked for this coverage plan. The website demonstrates the manner relating to in how you may attain this specific end. Additionally, it may clarify exactly what the program in conversation offers and that will be capable of registering for t.

Attributes Of the:

This is the Medicare Complement that warrants special Means in covering just about every promising additional expenditure. Even now, there can be number of clinical expenses you’ve to cover for yourself, and also this could possibly be a costly policy, however getting registered for that same requires a excellent ways to save a great deal of dollars. Maybe it is correct for you and perhaps it’s maybe not, and you also ought to require a couple times to have a glance at the same to find out it there. Countless seniors have saved some money regarding medical expenses of theirs by only registering up for the program Medicare Part F .It’s the best attention to detect what the master plan supplies and how it contrasts with your unique demands.

What’s your Medicare Plan Part F

Medicare plan or component F anything you like calling It, is basically the Medicare Supplement or Medigap policy (approach ). Any health supplement prepare arises with the thought of supplying more coverage for subscribers of Initial Medicare. Thus, despite using the first coverage available in case you necessitate more coverage, then without another idea go to your complement Plan simultaneously thereby committing yourself for at least one of these Plans.

This additional policy covers the costs that You need to subtract from the wallet. But, always select the exact plan that is appropriate for the needs you have. To know more about this Medicare program see https://www.comparemedicaresupplementplans.org/medicare-part-f/.